Balancing Growth and Profit: How to Choose Your Target CPA

Grow or die. Whether you’re running a mom and pop store or Amazon, every business needs to grow in one way or another. Even if your only goal is to replace the customers that you’ve lost, if you’re not actively trying to expand your business, your business probably won’t last for very long.

The problem is, acquiring new customers can be expensive—especially when you’re looking to do it at scale. But, despite what many business owners seem to believe, you don’t have to give up on profitability to achieve your growth goals.

While you do have to spend money to make money, if you know what you’re doing, you don’t have to put the financial stability of your business at risk to grow or even scale your business. To be honest, the last thing you want to do is destroy your business trying to grow it too aggressively.

So how do you balance growth and profitability? The secret is picking the right cost per acquisition (CPA) for your marketing efforts. And, in this article, we’re going to show you exactly how to do just that and use that CPA to affordably grow your business.

Why Picking the Right Cost Per Acquisition Matters

When it comes to growing your business, you can’t just push money into advertising and assume that you’ll get the results you need. Getting results is great, but if you can’t afford those results, then you may end up hurting instead of helping your business.

This is why it’s so important to figure out in advance what you can afford to spend to get a new customer. As a simple example, if you’re selling a product for $25 that costs $5 to make and $4 to ship, can you afford to spend $20 to get a new customer?

Maybe…maybe not.

If you only sell one product per new customer, than at this price point, you lose money on each sale. But, if people tend to buy multiple products at once or over time, then a $20 CPA could be profitable for your business.

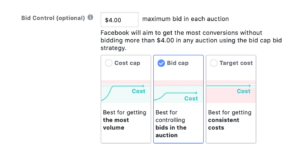

The good news is, these days it’s fairly easy to use your target CPA to control your online advertising. Both Google Ads and Facebook Ads allow you to control how much you spend acquiring new customers using bid caps or target CPA bidding.

With bid caps, you can control your CPA by choosing how much you’re willing to spend to get a click. So, if your target CPA is $400 and your site has a conversion rate of 1%, all it takes is a bit of quick math to determine that you can afford to spend up to $4.00 per click ($400 * 0.01 = $4.00).

Once you know what you can afford to spend to get a click, all you have to do is enter that number as your bid on Facebook or Google. It’s a bit manual, but it’s a tried and true approach.

On the other hand, if you want to let Facebook or Google’s algorithms control your bidding, you can set a target cost per acquisition and use automated bidding strategies (“Target cost” above for Facebook and “Target CPA” below for Google).

On average, Google and Facebook’s algorithms should keep your acquisition cost at or below your designated CPA. You might not get the best possible results, but it’s a very easy, hands-free way to get the results you need at a price you can afford.

How to Pick the Right Target CPA

So, now that we’ve talked about why picking the right cost per acquisition matters and how you can use it to affordably grow your business, it’s time to actually figure out your target CPA.

Step 1. Figure Out Your Customer Lifetime Value

How much is a new customer worth to your business? As we briefly discussed above, the answer to that question can be more complicated than it seems at first glance.

Some businesses only get one purchase per customer and every purchase is worth the same amount. However, that’s more the exception than the rule. If your business sells more than one product and/or gets repeat business, you’ll need to calculate the lifetime value of each new customer before you can figure out your target CPA.

There are a lot of ways to figure out your customer lifetime value (LTV), but the simplest is to take your total revenue and divide it by the number of customers over the last six months. So, if you made $200,000 in the last six months and had 5,000 customers, your average LTV would be $40.

Of course, if you get repeat business from your customers for a lot longer than that, you’d want to increase the time frame you look at, but the basic idea is still the same. The goal is simply to figure out how much—on average—a new customer is worth to your business.

Step 2. Calculate Your Costs

It would be nice if all of your revenue was straight profit, wouldn’t it? Unfortunately, you probably have employees to pay, product to buy or manufacture, shipping to pay for, facilities to keep running and many other costs to account for.

So, before you can figure out your target CPA, you need to figure out how much it actually costs to take care of a new customer. This should include variable costs like cost of goods sold and shipping, as well as all of your fixed costs like salaries, utilities and rent.

Again, there are a lot of ways to calculate your costs, but the simplest is to take all of your costs for the last six months (or whatever time frame you used for your LTV calculation) and divide it by your total number of customers. This will give you an average cost per customer.

So, if you spent $80,000 in the last six months and had 5,000 customers, your average cost per customer would be $16.

Then, to calculate your profit per customer, all you have to do is subtract your average cost per customer from your average LTV. If you made $40 per customer and spent $16 per customer, that would give you a profit of $24 per customer.

Your profit per customer is the money you have available to bring in new customers. Spend more than that, and you’re losing money on every sale. Spend less than that, though, and you can affordably grow your business.

Step 3. Choose Your Target CPA

Once you know what your profit per customer is, it’s time to decide on your target CPA. Here, you can pick anything ranging from $0 to your full profit margin. It all depends on what your growth goals are.

If you’re trying to grow aggressively, you’ll want to pick a CPA that’s on the higher side. The more you’re willing to spend, the more people you can reach with your advertising and the faster you’ll acquire new customers.

However, the downside to aggressive growth is that you won’t make as much money per customer. After all, if you have a profit per customer of $24 and you have a target CPA of $20, you’ll only make $4 per new customer. Sure, you might get 500 new customers this month, but you’ll only make $2,000 for your efforts.

Pick too low of a target CPA, though, and it will be hard to reach many people and make sales. For example, with a profit of $24 and a target CPA of $4, you make $20 per new customer, but you may only get 50 new customers this month, leaving you with just $1,000 for your trouble.

Ultimately, the right target CPA for your business will depend on your growth goals, your profit margin, your marketing channels and your target audience. To really nail down your target CPA, you’ll have to test out a few different channels and bidding strategies to see what works. But, as long as your target CPA falls within the range of your profit per customer, you should be able to optimize your growth strategy without negatively impacting your business.

Conclusion

At this point, you should hopefully have a pretty good sense for how to figure out and use your target cost per acquisition. To be honest, if you’re going to invest in online advertising, this should be one of the first things you figure out.

I’ve seen far too many businesses waste countless thousands of dollars on online advertising because they wanted to grow without knowing whether or not that growth was sustainable.

The good news is, once you know what your target CPA is, you can test and try different marketing channels and strategies until you find one that really works for your business. Figuring out your target CPA puts you in the driver’s seat for your business—it gives a benchmark you can use to evaluate your advertising and what works for your business.